Navigate to this page under Items -> Taxes.

Powercode has a powerful and flexible tax implementation. To apply taxes to services, you must create a matrix of two variables in Powercode – tax types and tax zones.

A tax zone is a location which imposes tax types on services. An example of a zone would be the state of Wisconsin or the province of Alberta. You may also have smaller zones – in Wisconsin, there may be different sales tax in Milwaukee vs Madison. The naming of these zones is arbitrary and is up to you – you can have as many zones as you want. You probably will want to, at a minimum, create a Tax Exempt zone which will have a 0% tax in all of its tax types so you can setup tax exempt customers in your Powercode installation.

A tax type is a type of tax. For example, sales tax or USF.

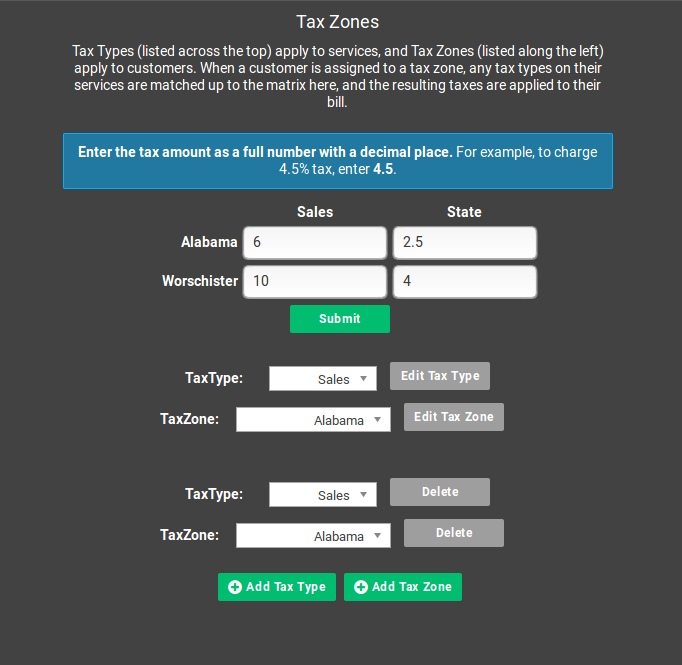

You add both tax types and tax zones at the bottom of the screen. After adding all your types and zones you are left with a matrix as follows:

Now you simply enter the percentage of tax to enter in a specific zone by type in the appropriate box. In our example, to charge 10% sales tax in Alberta, we would enter ’10’ in the Sales column where it intersects with the row labeled Alberta.

Applying Taxes

When you create or edit a customer, you will have a chance to select which tax zone they reside in. When you create or edit a service, you can select which types are associated with the service. Now when a customer is billed, powercode will calculate the tax per service by matching their tax zone to the appropriate tax types.